City of London revealed as a UK region where you’re most likely to be scammed online

- Cybersecurity Crisis – UK hit with over 400,000 reported cases last year

- Cybercriminals cash in on Black Friday with 10% increase in reports

- City of London ranks second behind Northamptonshire in list of places most at risk in the UK

New research by one of Europe’s leading price comparison sites, idealo.co.uk, has revealed the regions most affected by online fraud, and in particular shopping scams, as we head towards the busiest shopping season on the year.

idealo analysed the data from the NFIB Fraud and Cyber Crime Dashboard* to highlight the concerning trend, finding that a total of 407,369 cybercrime cases had been reported over the last 13 months in the UK.

What’s even more alarming, is that in the run up to Black Friday, between September and November, reports of cybercrime incidents increased by a significant 10%. This uplift underscores the urgent need for more awareness and extra precautions as consumers will embrace online shopping for higher ticket items during Black Friday and

Online shopping scams are costing UK consumers the most. The data shows a staggering £104.4million was lost in just over a year due to these frauds and that one in five consumers have been targeted, making online shopping scams the most reported crime category.

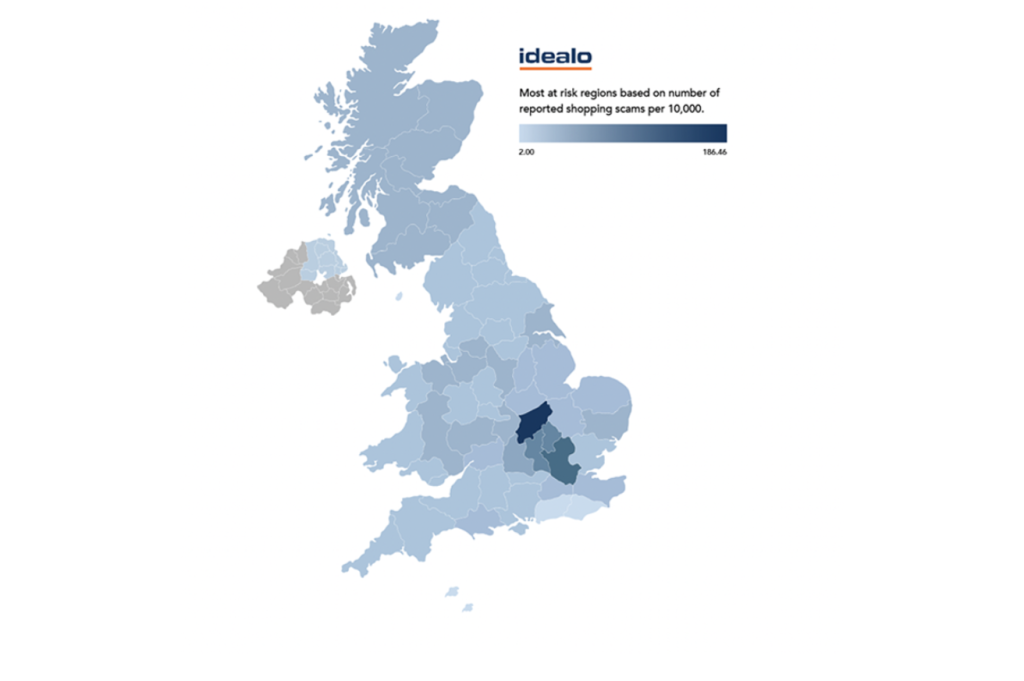

The UK’s 20 most scammed regions according to idealo

- Northamptonshire

- City of London

- Thames Valley

- Bedfordshire

- Dyfed-Powys

- Wiltshire

- Hertfordshire

- West Mercia

- Suffolk

- Dorset

- Cambridgeshire

- Cheshire

- Derbyshire

- Gloucestershire

- Warwickshire

- Lincolnshire

- West Midlands

- Greater Manchester

- Kent

- Scotland

Northamptonshire, the second smallest region in the UK, including the towns of Northampton, Kettering and Corby, tops the list as the most at risk area for online shopping scams. The data shows that per 10,000 people, this region sees 186.46 cases which is around 20 times higher than the national average.

The smallest region, City of London, also surprisingly follows behind in second place but with a much lower average of 18 cases per 10,000.

Interestingly, data for some of largest and most populated areas in the UK such as Greater Manchester, the West Midlands and Yorkshire shows significantly less reports of consumer fraud.

Ranked at 17 and 18 in the list, Greater Manchester and the West Midlands, whilst they’re regions still at risk, show fewer cases of reported online scams with around 10 per 10,000.

As for West Yorkshire, which includes cities Leeds and Bradford, the UK’s fourth largest urban agglomeration, it doesn’t even make it into the 20 most scammed regions with just 9.17 cases per 10,000 people.

Katy Phillips, senior brand and communication manager at idealo commented on the findings: “Conducting this research was really informative, and as part of our mission to help shoppers when it comes to saving their money, as well as feeling confident and safe when shopping online, we knew it was important to raise awareness of online shopping scams and the financial damage they cause ahead of the busy shopping period.

“Whilst we already knew that this criminal activity increases around well-known sale events, we were shocked to see a 10% increase in reports around Black Friday alone. It’s also important to remember that this data only shows reported cases, we expect that many more cases have not been reported due to stigmas attached to falling victim to said crimes.

“Ahead of this year’s event, we’re urging shoppers to stay vigilant when shopping online and reminding of some tips to remember:

- Verify the Website – Before making a purchase, ensure the website is legitimate. Check the URL for any typos or inconsistencies and look for a padlock symbol in the address bar, indicating a secure connection.

- Research the Seller – Read reviews from other customers to assess the seller’s reputation. Look for feedback about product quality, delivery times, and customer service.

- Use Secure Payment Methods – Opt for payment methods that offer buyer protection, such as credit cards or trusted online payment platforms. Avoid sharing personal financial information directly with unfamiliar sellers.”