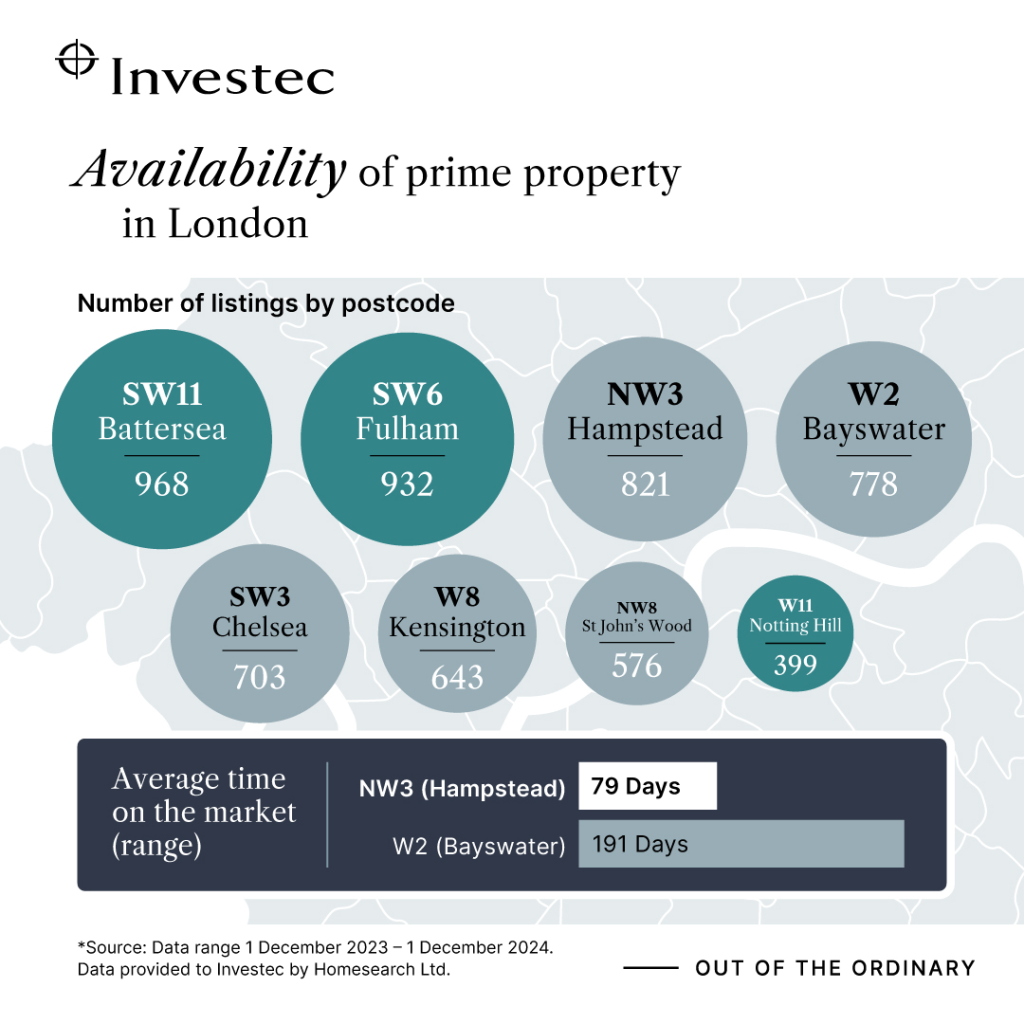

- Significant variance in average selling time of prime properties between London postcodes, with £1m+ homes typically selling in Bayswater in 191 days compared to only 87 in Fulham and 79 in Hampstead.

- The average reduction in the original asking price on properties listed for £1m+ in Greater London was £200,100, but some areas reducing by up to 11.3%, which translated to savings of over £313,245 in Kensington (9.2% down) and £311,266 in Chelsea (9.7% down).

- The average speed of sale ranged by over 15 weeks: from 79 days in Hampstead to 191 in Bayswater.

- On a square foot basis, London’s prime property markets showed significant variations, with prime property in Fulham (SW6) being £779 per sq ft cheaper than in neighbouring Chelsea (SW3).

Investec Bank plc (Investec), a leading international financial services provider, has unveiled its latest findings on London’s prime property market, revealing that £1m+ homes in parts of London often languished on the market for well over six months. Presenting an opportunity for buyers to maximise their value for money in the prime sector, the index shows that prime property across Greater London has typically fallen by over £200,000, with some areas witnessing falls of over £300,000.

Within Greater London, prime properties were selling within 100 days, but significant differences were seen between London postcodes, with South West postcodes offering the most choice for buyers, with the most £1m+ properties for sale. In Bayswater, properties sold in an average of 191 days, Chelsea (SW3) in 130 days and St. John’s Wood (NW8) in 149, compared to those in Hampstead (NW3) that sold in just 79 days.

Average time on the market for £1m+ Homes

|

W2 (Bayswater) |

191 |

|

NW8 (St John’s Wood) |

149 |

|

SW3 (Chelsea) |

130 |

|

W8 (Kensington) |

128 |

|

W11 (Notting Hill) |

114 |

|

SW11 (Battersea) |

97 |

|

SW6 (Fulham) |

87 |

|

NW3 (Hampstead) |

79 |

Prime property across Greater London typically fell by £200,000, but the index showed substantial price differences across London, with some areas experiencing double-digit falls in prices. Hampstead fell 11.3% (translating to a £305,220 reduction), Bayswater by 10.5% (£261,081 reduction) and Chelsea by 9.7% (£311,266 reduction).

Average Price Reduction £1m+ Homes (by % discount):

|

NW3 (Hampstead) |

£305,220 |

-11.30% |

|

W2 (Bayswater) |

£261,081 |

-10.50% |

|

SW3 (Chelsea) |

£311,266 |

-9.70% |

|

W8 (Kensington) |

£313,245 |

-9.20% |

|

NW8 (St John’s Wood) |

£325,219 |

-8.40% |

|

SW11 (Battersea) |

£153,723 |

-8.20% |

|

W11 (Notting Hill) |

£228,417 |

-7.70% |

|

SW6 (Fulham) |

£150,709 |

-7.35% |

The capital can also be viewed as a patchwork of pockets, each representing distinct individual markets. This diversity presents significant opportunities for buyers willing to adjust their search to postcodes that offer greater value and move just a few streets away; with prime property in Fulham £779 per square foot cheaper last year than in neighbouring Chelsea.

Average Price per Square Foot of £1m+ Homes:

|

SW3 (Chelsea) |

£1,934 |

|

W8 (Kensington) |

£1,863 |

|

W2 (Bayswater) |

£1,745 |

|

W11 (Notting Hill) |

£1,692 |

|

NW8 (St John’s Wood) |

£1,516 |

|

NW3 (Hampstead) |

£1,349 |

|

SW11 (Battersea) |

£1,255 |

|

SW6 (Fulham) |

£1,155 |

Carlos Mendes, Private Banker at Investec, commented: “London offers exceptional value for money for those willing to look just a few roads away from their target postcodes, with prime property often hundreds of pounds cheaper per square foot.”

“Now is the time for buyers to take advantage of some significant price reductions and take the opportunity to secure a prime property in some of London’s most desirable areas with reductions of over £300,000 being seen in some postcodes. However, for sellers, it’s essential that they recognise that not all areas moved at the same pace, and pricing strategies need to be flexible if they want to secure a sale.”

Investec’s insights provide valuable guidance for those navigating the complexities of London’s property landscape, helping buyers to make informed decisions in a rapidly evolving environment.

Investec offers a range of private bank accounts for clients earning at least £300,000 a year and with a minimum net worth of £3 million. Clients are looked after by a dedicated private banker who can provide tailored banking, borrowing, savings solutions, or foreign exchange. Investec looks at income levels holistically, considering more than just a basic salary, and often incorporates bonuses, carried interest, or income from profit shares in its calculations. Investec’s relationship-led approach and in-house specialists mean that it can provide a lending decision and loan amount within days.

Investec provides mortgages for both residential and buy-to-let properties, which are tailored to each client’s needs, whether it is replacing an existing mortgage or obtaining a loan against a new property. Individuals do not need to have a savings or investment portfolio with us to apply for a mortgage.